Nudging low- to moderate-income households to save more

October 2020

The challenge

Many people do not save enough money to face unexpected expenditures, tragic events, or job loss, especially low- to moderate-income households. This leads them to look for immediate sources of money, such as high-interest loans, payday loans, having an overdraft, or borrowing from family members. Those actions often trap them in a cycle of debt making their situation even worse.

The day-to-day financial decisions made by people such as spending, saving, or using consumer credits affect their poverty status. Our client, a financial institution, is aiming to help Tunisians save more in order to improve their financial and mental wellbeing facing the country’s economic instability.

The challenge

Many people do not save enough money to face unexpected expenditures, tragic events, or job loss, especially low- to moderate-income households. This leads them to look for immediate sources of money, such as high-interest loans, payday loans, having an overdraft, or borrowing from family members. Those actions often trap them in a cycle of debt making their situation even worse.

The day-to-day financial decisions made by people such as spending, saving, or using consumer credits affect their poverty status. Our client, a financial institution, is aiming to help Tunisians save more in order to improve their financial and mental wellbeing facing the country’s economic instability.

The Qualitative Research

What are the barriers and drivers of household saving behavior?

The Qualitative Research

What are the barriers and drivers of household saving behavior?

Along with a review of the behavioral science literature, we arranged interviews with experts in the financial field, we conducted semi-structured interviews and focus groups with participants from different backgrounds and income levels.

We aimed to identify the factors that encourage or discourage saving behaviors. Among the barriers to saving, we highlight the procrastination and the lack of motivation. Participants claim that they are going to save when they start earning more, they have to pay off debt, saving is not going to make them wealthier, and that they prefer living in better conditions today.

Along with a review of the behavioral science literature, we arranged interviews with experts in the financial field, we conducted semi-structured interviews and focus groups with participants from different backgrounds and income levels.

We aimed to identify the factors that encourage or discourage saving behaviors. Among the barriers to saving, we highlight the procrastination and the lack of motivation. Participants claim that they are going to save when they start earning more, they have to pay off debt, saving is not going to make them wealthier, and that they prefer living in better conditions today.

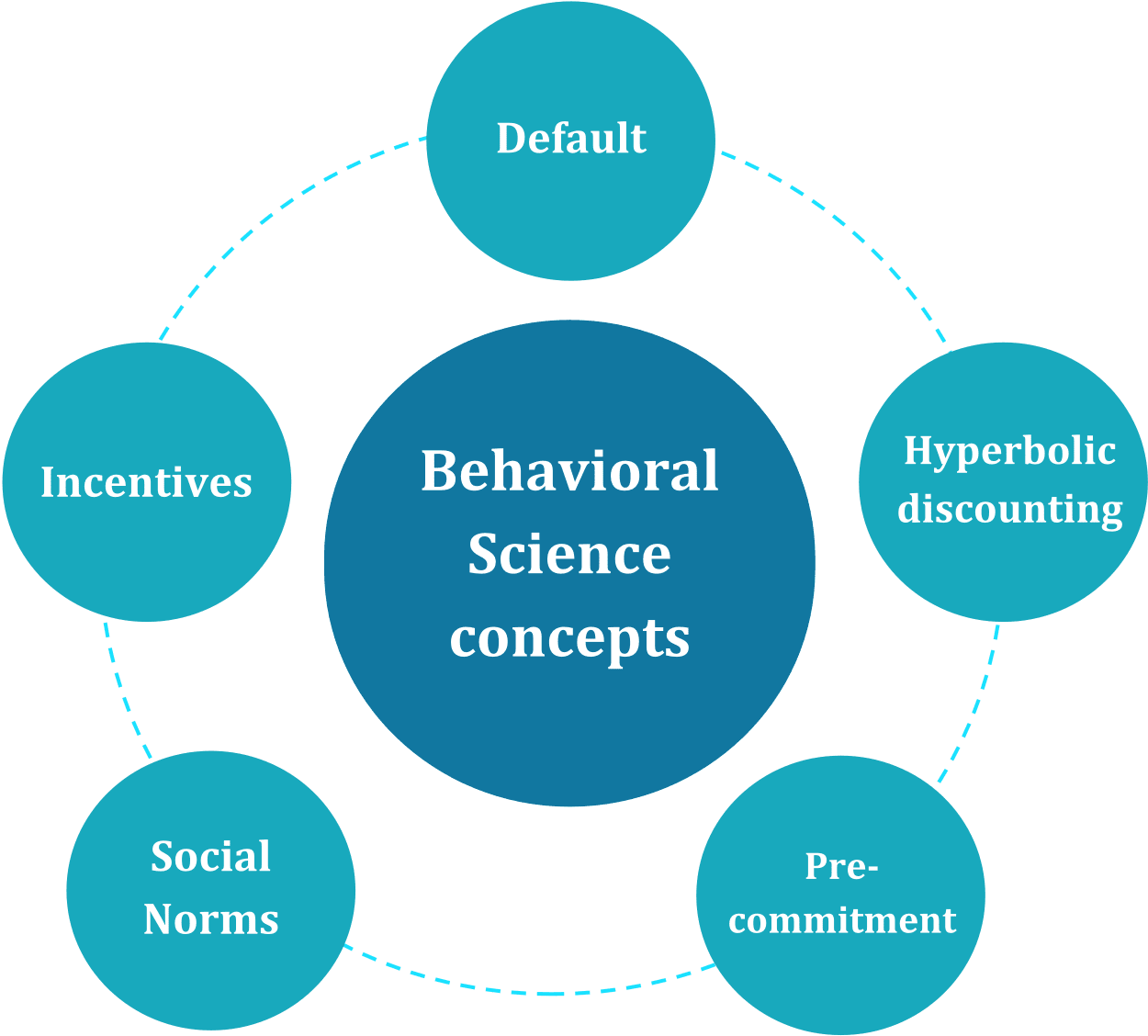

Behavioral Insights

What Behavioral science concepts could help us in designing effective nudges?

Behavioral Insights

What Behavioral science concepts could help us in designing effective nudges?

Hyperbolic discounting

Individuals tend to overweight rewards that are closer to the present time and discount costs in the future. In other words, when people choose an immediate reward rather than a higher-value, delayed reward. For example, when given the choice between receiving $50 today versus $100 a year from now, many people will choose the $50 today. But when offered $50 in five years versus $100 in six years, the majority will prefer the latter.

Hyperbolic discounting may explain why Tunisians don’t save enough, especially low-income individuals who exhibit the present bias more than high-income individuals do. Examples include why people overspend on immediate gratification and don’t make pension contributions.

Default

Default options are pre-selected choices that people can change if they want. Defaults are powerful where there is inaction or uncertainty. They are also perceived as recommended in the case of complex and difficult decisions, such as financial decisions. Setting defaults has proved to be effective in different situations like organ donation or enrolling into pensions at work.

Incentives

An incentive is something that motivates an individual to perform an action. Incentives can be intrinsic or extrinsic. They are shown to be an effective strategy to promote a positive behavior change in different areas like health and finance.

High-interest rates encourage people to save more. Experiments demonstrated the effectiveness of interest and rewards in many Western countries.

Social norms

According to the social norms theory people are likely to compare each other and are influenced by how others think and act. Social norms could influence saving decisions. When people assume that others don’t save and overspend, they tend to not save either. However, if they know that others are saving, and saving is the norm, they become more encouraged to save.

In all our interventions, we are testing the social norms effect: by asking employees to mention the number of customers enrolled in saving programs (either by having an automatic saving account or a pre-commitment agreement) or by adding related information in the saving programs brochures and webpage.

Hyperbolic discounting

Individuals tend to overweight rewards that are closer to the present time and discount costs in the future. In other words, when people choose an immediate reward rather than a higher-value, delayed reward. For example, when given the choice between receiving $50 today versus $100 a year from now, many people will choose the $50 today. But when offered $50 in five years versus $100 in six years, the majority will prefer the latter.

Hyperbolic discounting may explain why Tunisians don’t save enough, especially low-income individuals who exhibit the present bias more than high-income individuals do. Examples include why people overspend on immediate gratification and don’t make pension contributions.

Default

Default options are pre-selected choices that people can change if they want. Defaults are powerful where there is inaction or uncertainty. They are also perceived as recommended in the case of complex and difficult decisions, such as financial decisions. Setting defaults has proved to be effective in different situations like organ donation or enrolling into pensions at work.

Incentives

An incentive is something that motivates an individual to perform an action. Incentives can be intrinsic or extrinsic. They are shown to be an effective strategy to promote a positive behavior change in different areas like health and finance.

High-interest rates encourage people to save more. Experiments demonstrated the effectiveness of interest and rewards in many Western countries.

Social norms

According to the social norms theory people are likely to compare each other and are influenced by how others think and act. Social norms could influence saving decisions. When people assume that others don’t save and overspend, they tend to not save either. However, if they know that others are saving, and saving is the norm, they become more encouraged to save.

In all our interventions, we are testing the social norms effect: by asking employees to mention the number of customers enrolled in saving programs (either by having an automatic saving account or a pre-commitment agreement) or by adding related information in the saving programs brochures and webpage.

Interventions Design

Low-cost interventions based on insights from behavioural science

Interventions Design

Low-cost interventions based on insights from behavioural science

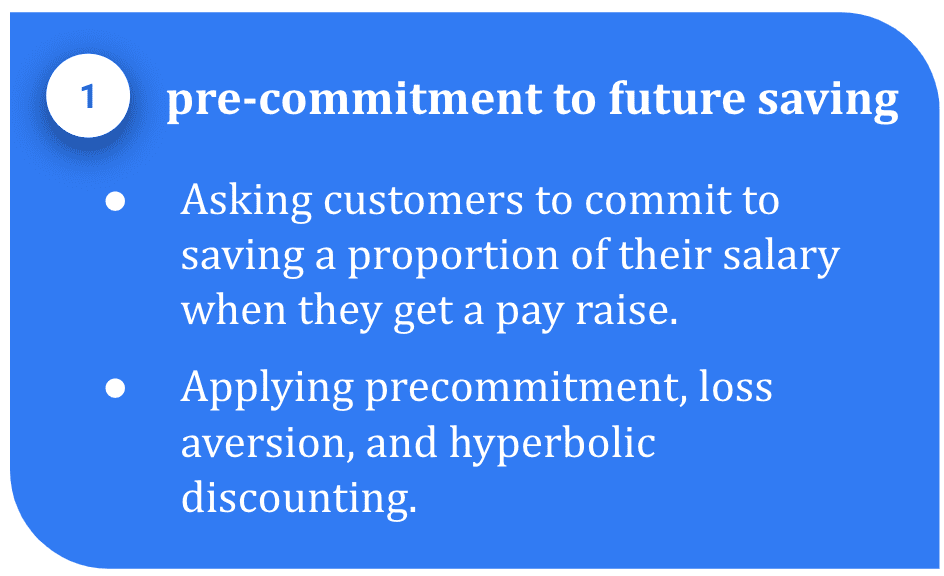

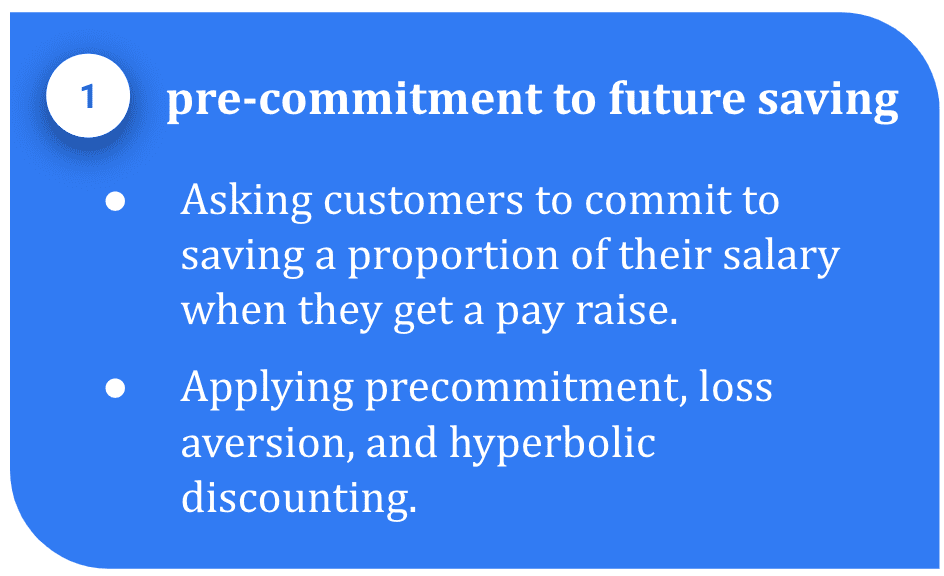

Intervention 1: pre-commitment to future saving

Precommitment is a frequently applied behavioral strategy to motivate positive change. Our intervention consists of asking customers to commit to saving a proportion of their salary when they get a pay raise. This solution is based on precommitment and other theories from behavioral economics like loss aversion and hyperbolic discounting.

The idea is inspired by the successful ‘Save More Tomorrow’ program proposed by Richard Thaler and Shlomo Benartzi in 2004. It’s a plan where employees increase pension savings in the future when their salaries increase. The program quadrupled pension contributions in the US and has been applied since, in many countries. We are trying to test the idea on short-term savings in Tunisia.

Precommitment is a frequently applied behavioral strategy to motivate positive change. Our intervention consists of asking customers to commit to saving a proportion of their salary when they get a pay raise. This solution is based on precommitment and other theories from behavioral economics like loss aversion and hyperbolic discounting.

The idea is inspired by the successful ‘Save More Tomorrow’ program proposed by Richard Thaler and Shlomo Benartzi in 2004. It’s a plan where employees increase pension savings in the future when their salaries increase. The program quadrupled pension contributions in the US and has been applied since, in many countries. We are trying to test the idea on short-term savings in Tunisia.

Intervention 2: automatic saving accounts

Usually, there is a gap between intention and action when it comes to saving. We proposed defaulting customers into automatic savings programs by bundling their checking accounts with savings accounts.

Studies of the Center for Advanced Hindsight Common Cents Labs on automatic savings with Payable showed that people prefer ease and automaticity when signing up even though they dislike the lack of control. This could also be an effective nudge when people procrastinate due to a lack of self-control and inertia.

Usually, there is a gap between intention and action when it comes to saving. We proposed defaulting customers into automatic savings programs by bundling their checking accounts with savings accounts.

Studies of the Center for Advanced Hindsight Common Cents Labs on automatic savings with Payable showed that people prefer ease and automaticity when signing up even though they dislike the lack of control. This could also be an effective nudge when people procrastinate due to a lack of self-control and inertia.

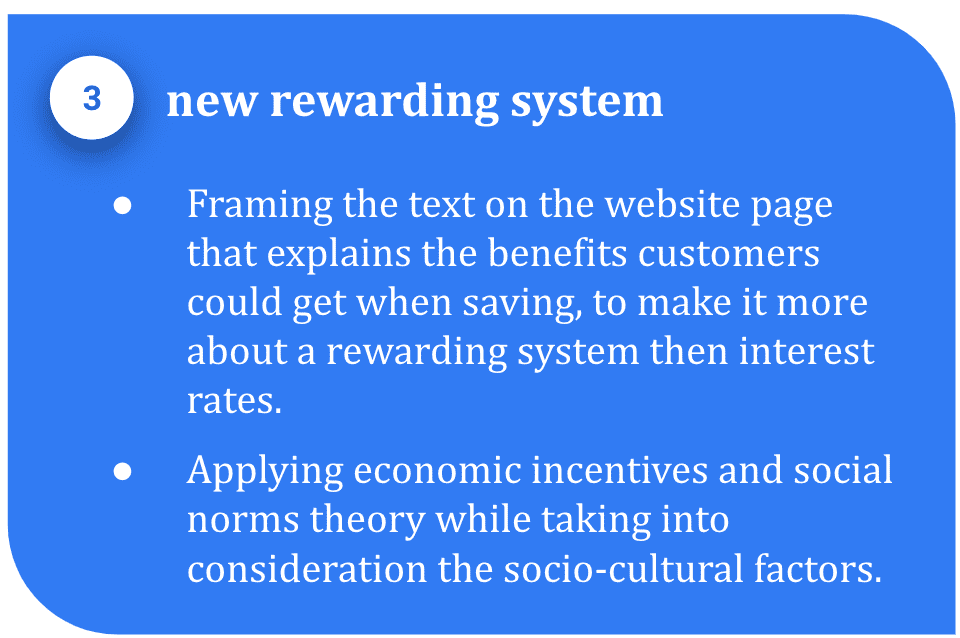

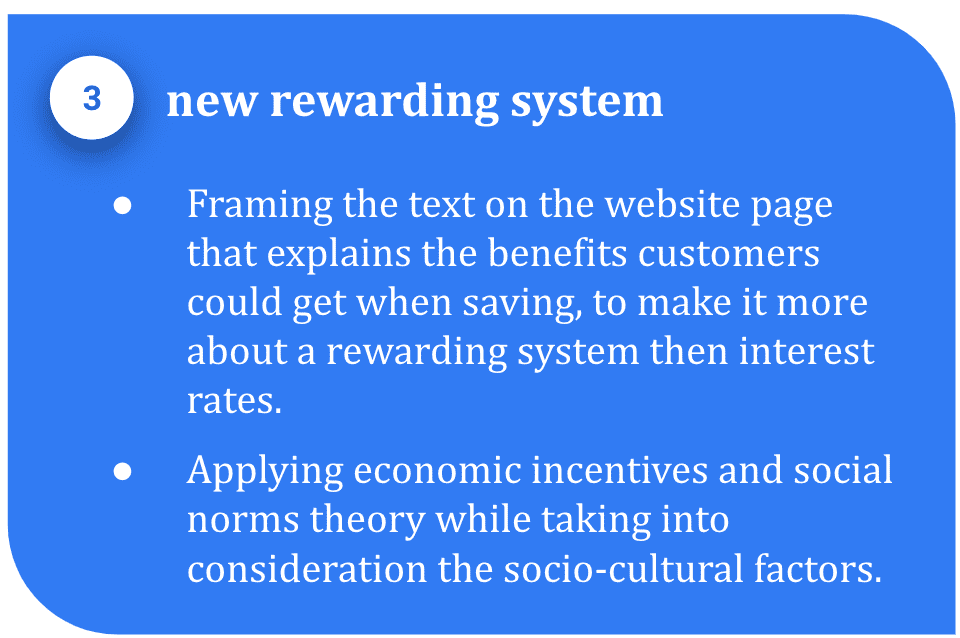

Intervention 3: incentives and cultural barriers

Our research shows that many Tunisians are not motivated by the interest and don’t even consider it in saving decisions. This could be explained by the cultural factor. The majority of Tunisians, especially the more religious, consider benefiting from interest as forbidden or wrong.

We changed the text on the website to make it more about a rewarding system then interest rates when explaining the benefits customers could get when saving, as the word “interest” has a negative connotation in the Arabic culture.

Our research shows that many Tunisians are not motivated by the interest and don’t even consider it in saving decisions. This could be explained by the cultural factor. The majority of Tunisians, especially the more religious, consider benefiting from interest as forbidden or wrong.

We changed the text on the website to make it more about a rewarding system then interest rates when explaining the benefits customers could get when saving, as the word “interest” has a negative connotation in the Arabic culture.

The Experimentation

To test our interventions, we designed a series of randomized controlled experiments to be run all over the institution branches.

In Tunisia, online financial services and communications are not yet developed. Customers need to be physically present to open accounts, sign up for services, or make main changes. Besides, the qualitative research participants stated that they still don’t trust online financial transactions and services, especially when it’s an important commitment.

All of our experiments, except one, were designed to be run at the institution branches. We ask customers when they are present at offices in order to encourage immediate action, build trust, and avoid confusion and lack of information. We trained the employees to help in collecting data and taking observation notes.

To test our interventions, we designed a series of randomized controlled experiments to be run all over the institution branches.

In Tunisia, online financial services and communications are not yet developed. Customers need to be physically present to open accounts, sign up for services, or make main changes. Besides, the qualitative research participants stated that they still don’t trust online financial transactions and services, especially when it’s an important commitment.

All of our experiments, except one, were designed to be run at the institution branches. We ask customers when they are present at offices in order to encourage immediate action, build trust, and avoid confusion and lack of information. We trained the employees to help in collecting data and taking observation notes.

Experiment 1

We asked new and old customers to commit to an increased saving proportion or to start saving when they get a pay raise. Customers are free to choose the percentage and they are informed that they can change their minds if they want to. We aimed to ensure the feelings of control, freedom, and trust.

Experiment 2

We asked new customers at the time of creating a checking account to create a savings account and set an automatic transfer monthly. Customers are free to choose the percentage of savings, the date of the automatic transfer, and when the plan starts. Creating two accounts at once has become the new default, but customers can opt-out and ask to not create a savings account.

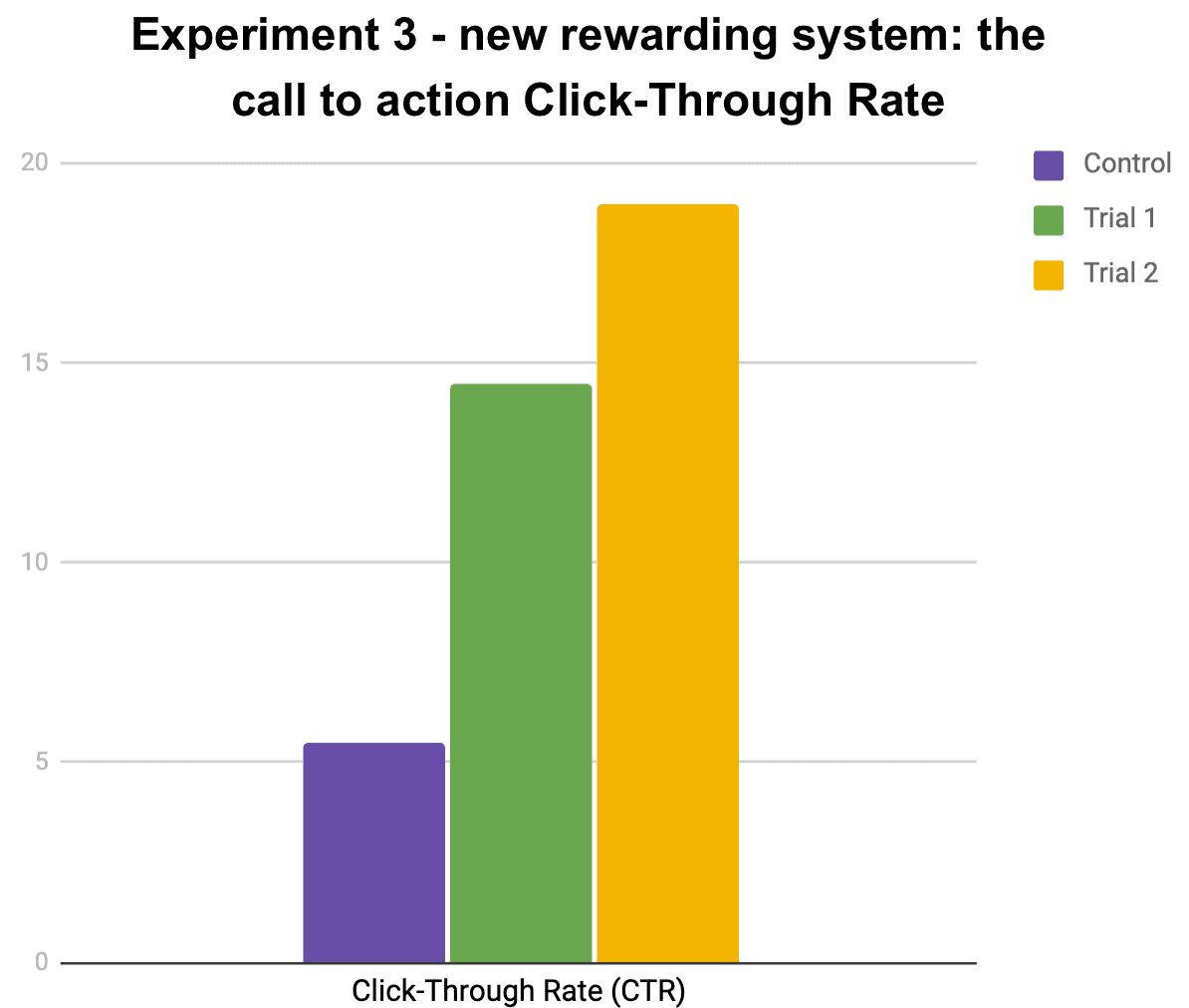

Experiment 3

- The control: the original text

- Trial 1: replacing interest by reward

- Trial 2: replacing interest by reward and highlighting the social factor.

We added a call to action to all conditions asking users to check more information. The aim is to know if users are interested in the reward system. Since users can’t sign in to savings programs online, the click-through rate was our main indicator. We kept the experiment running for two months.

To test our interventions, we designed a series of randomized controlled experiments to be run all over the institution branches.

In Tunisia, online financial services and communications are not yet developed. Customers need to be physically present to open accounts, sign up for services, or make main changes. Besides, the qualitative research participants stated that they still don’t trust online financial transactions and services, especially when it’s an important commitment.

All of our experiments, except one, were designed to be run at the institution branches. We ask customers when they are present at offices in order to encourage immediate action, build trust, and avoid confusion and lack of information. We trained the employees to help in collecting data and taking observation notes.

To test our interventions, we designed a series of randomized controlled experiments to be run all over the institution branches.

In Tunisia, online financial services and communications are not yet developed. Customers need to be physically present to open accounts, sign up for services, or make main changes. Besides, the qualitative research participants stated that they still don’t trust online financial transactions and services, especially when it’s an important commitment.

All of our experiments, except one, were designed to be run at the institution branches. We ask customers when they are present at offices in order to encourage immediate action, build trust, and avoid confusion and lack of information. We trained the employees to help in collecting data and taking observation notes.

Experiment 1

We asked new and old customers to commit to an increased saving proportion or to start saving when they get a pay raise. Customers are free to choose the percentage and they are informed that they can change their minds if they want to. We aimed to ensure the feelings of control, freedom, and trust.

Experiment 2

We asked new customers at the time of creating a checking account to create a savings account and set an automatic transfer monthly. Customers are free to choose the percentage of savings, the date of the automatic transfer, and when the plan starts. Creating two accounts at once has become the new default, but customers can opt-out and ask to not create a savings account.

Experiment 3

- The control: the original text

- Trial 1: replacing interest by reward

- Trial 2: replacing interest by reward and highlighting the social factor.

We added a call to action to all conditions asking users to check more information. The aim is to know if users are interested in the reward system. Since users can’t sign in to savings programs online, the click-through rate was our main indicator. We kept the experiment running for two months.

Main findings

Experiments 1 & 2 are ongoing, we are still collecting data. According to the initial findings, the interventions are successful. As more customers are now opening automatic saving accounts and signing in for future saving programs. In fact, just asking or changing the default has stimulated many users to act and reduced the gap between intention and action. We will run the experiments for the next four months to collect more data in order to decide on the most effective way to implement the interventions.

Experiment 3 was concluded after two months. On the control page, only 5.5% of users clicked on the call to action. The rate increased by 9% when we framed the text to make it more about a rewarding system then interest rates. The click rate rose to 19% when we added information about the number of users enrolled in the rewarding system. .